Submit SASSA SRD Re-Appeal Online | Instant Approval Official

SASSA SRD Beneficiaries possess a lawful right for Re-appeal in the Independent SASSA Tribunal against unfair rejection during the initial SASSA Appeal. Therefore, this article will guide on “How To Re-Appeal SASSA SRD?”

Officially, SASSA rejects initial appeals for various reasons, including mismatched information, incomplete verification, temporary income records, UIF data errors, conflicting bank data, or identity verification problems.

Therefore, understanding the core reasons for SASSA SRD Appeal rejection is key to avoiding denial in the Re-appeal Process. For utmost success in SASSA SRD Re-appeal, update your details, attach the correct information, and follow the official steps.

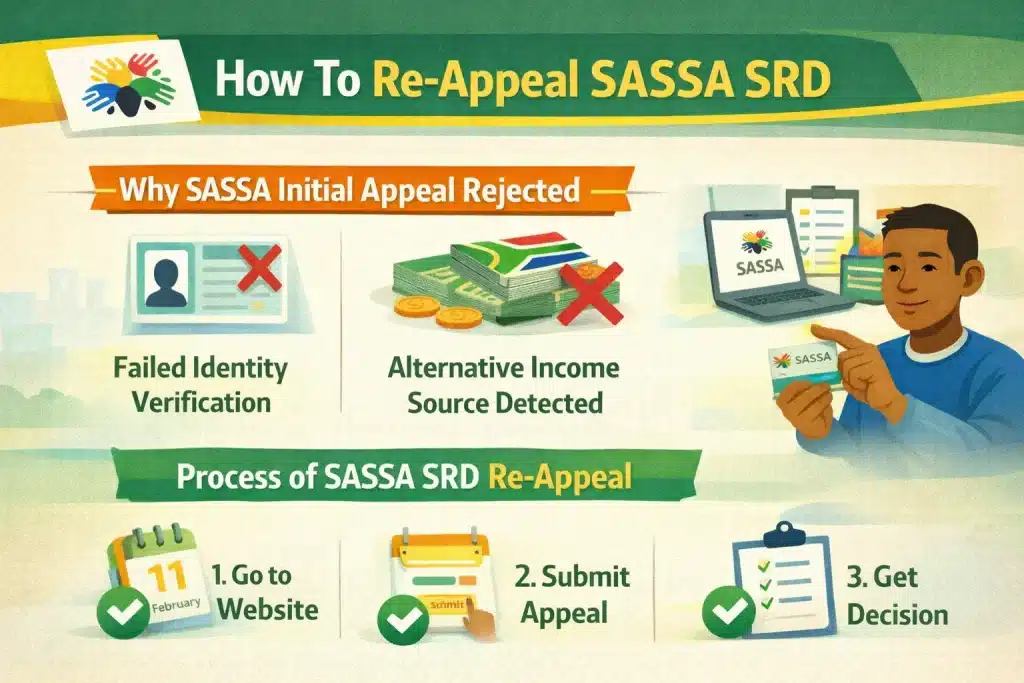

Why SASSA Initial Appeal Rejected

Several applicants are rejected in their SASSA SRD appeals due to problems that can be easily avoided with proper knowledge and documentation. Being informed of the usual reasons would help applicants improve their preparation and reduce the risk of another failed review.

Failed Identity Verification

When personal information does not appear on official documents, SASSA refuses to provide any services. Minor spelling mistakes or ID number errors can cause a check-up to fail. This measure ensures that benefits are not issued without the applicant’s identification.

Alternative Income Source Detected

Such an appeal will be dismissed in case SASSA discovers any incoming funds that may indicate financial assistance. This includes bank deposits above the income limit. The system verifies the bank’s activities to ensure a genuine financial need.

UIF or NSFAS Registration

Registered applicants to UIF or NSFAS-funded applicants may seem financially subsidized. According to SASSA, these programs are used as a measure of income or aid. For this reason, the appeals of such applicants may fail.

Existing Employment Records

If the system identifies any employment-related information associated with your ID, the appeal may be denied. An old or outdated job record can also affect eligibility. SASSA presumes that employed people do not qualify in full for the SRD grant.

Incorrect Supporting Information

Providing incorrect or incomplete information in the appeal may result in instant rejection. SASSA considers proper documentation a requirement for claiming. An instance of any mismatch impairs the trustworthiness of the application.

Fraudulent or Suspicious Activity

If the SASSA system detects abnormal patterns or a possible case of fraud, the appeals are rejected. This entails the inclusion of several accounts or inaccurate information. The vision is to ensure the integrity of the SRD program.

Bank Verification Failed

There are also rejections due to inactive, mismatched, or faulty bank account provision. SASSA will have to ensure that the applicant owns the account. A payment cannot be made without successful bank verification.

Age or Citizenship Ineligibility

Applicants who do not pass the citizenship and age requirements are automatically disqualified. The SRD grant is restricted to South African citizens, permanent residents, or refugees.Any other person not falling in these brackets fails to qualify.

Process of SASSA SRD Re-Appeal

The SASSA SRD re-appeal provides an opportunity for any applicant to seek a second review if their first appeal failed. It provides an opportunity to amend information, provide revised details, or clarify eligibility issues.

- Go to the official SASSA SRD appeals site and start the re-appeal process.

- Insert ID and mobile number that were used when you made your SRD grant application.

- Ask to have a new appeal opportunity in the same month as the rejected one.

- Present the appropriate, revised data needed to obtain the verification.

- Add any documents that may prove your case to be stronger.

- Go through all of it really thoroughly before placing the re-appeal.

- Send the appeal and wait to receive an SMS or an online update of SASSA.

- Arguably, monitor the status of your appeal by checking it frequently to avoid any additional information requirements.

Tips For Successful SASSA Re-Appeal

The re-appeal of the SASSA is not possible without fear of missing out on information, documents, and eligibility details. Most applicants are approved, with minor errors corrected or stronger evidence presented.

Confirm Eligibility For Re-appeal

Be sure you do not miss any SRD eligibility requirements, such as age, citizenship, and income. When a person becomes ineligible, it is a waste of time to re-appeal. Awareness of the criteria will improve approval rates.

Double-Check Your Personal Details

Ensure that your ID number, phone number, and name are officially registered. Minor mistakes may lead to verification failure. The right information helps SASSA confirm your identity in a good time.

Provide Updated Bank Information

Make sure your bank account is operational and under your name. Wrong or inactive accounts are automatically rejected. Updating a child’s banking information improves the accuracy of recurring payments.

Submit Strong Supporting Documents

During the SASSA Re-appeal process provide paperwork that can demonstrate your financial status. They may be bank statements, UIF status evidence, or affidavits. These will give credibility to your appeal.

Remove Any Income Conflicts

Look into deposits that can be treated as income, such as family transfers. Where practical, justify or prevent unnecessary deposits within the period of time of review. SASSA issues banking checks to verify your need.

Keep Your Contact Details Updated

SASSA sends you decisions and requests using your phone number. If you change your number, do so as soon as possible. The lack of communication can slow or undermine your SASSA SRD Re-appeal process.

Appeal for Each Rejected Month

SASSA considers each month individually; therefore, you need to resubmit it on a case-by-case basis. Missing months would lead to partial reviews. Always review all the rejected months before submission.

Check Your Appeal Status Frequently

Periodically follow up on the appeals portal. This is to ensure you provide prompt replies in case you are required to furnish more information. Keeping up with the times will help you prevent unnecessary delays.

Challenges in SASSA SRD Re-Appeal

The SASSA SRD re-appeal process poses challenges for most applicants due to stringent verification policies and procedural checks. Such issues tend to lengthen approval times and confuse users. Knowledge of such issues will help applicants avoid pitfalls.

Slow Verification Process

The re-appeal process may be time-consuming, as there are many applications. There is always a delay with SASSA in confirming identity, income, and banking information. This makes the waiting process stressful for most applicants.

System Errors and Portal Glitches

Sometimes, when submitting to human lines on the appeal site, submissions fail due to technical issues. Issues such as failed logins or slow-loading pages interrupt the process. This forces applicants to reapply several times.

Banking Verification Problems

Another reason many appeals are delayed is the failure to check bank accounts. This occurs due to inactivity, account imbalance, or entry errors. Without successful bank confirmation, SASSA cannot process payments.

Incorrect or Outdated Information

Stale or inaccurate information always dilutes appeals. The most minor errors in ID number, names, or income details result in rejection. It is essential to keep all information up to date to be approved.

Limited Communication from SASSA

As an applicant, one is sometimes not updated or SMS-notified in time. The lack of communication can be an issue, as it is hard to know the re-appeal status. This confuses many of them regarding the course of action.

Confusion About Rejection Reasons

The rejection notice does not always make sense to SASSA applicants. Unless they understand, they cannot rectify the problem. This leads to appeals being rejected several times.

Monthly Appeal Requirement

Every month, rejected applicants have to reapply, making it time-consuming. Losing one month is losing an opportunity to rethink. This is an additional burden on the procedure, which certainly requires more time.

Income Flag Issues

Lastly, the income flag may be triggered by small deposits or by a single transfer. Even the non-salary payments are shown as earnings in the system. This complicates the applicants’ financial hardship.

Conclusion

In short, the SASSA SRD re-appeal process provides applicants with a second chance if rejected at the initial SASSA appeal. It allows one to enter revised information or correct information that influenced their result. Of course, knowledge of how to re-appeal is crucial for having a fair chance of being reviewed and gaining acceptance. Lastly, bookmark our website and enable the notification icon to receive alerts about the Official SASSA Announcements and News.

FAQs

Who is allowed to submit a SASSA SRD re-appeal?

Any applicant whose first SRD appeal was denied can re-appeal. As long as the rejection reason still applies, you can request another review.

Do I need new documents for a re-appeal?

Not always, but it helps to update any outdated or incorrect information. If your bank, income, or personal details have changed, include those updates in your appeal.

Is there a deadline for submitting an SRD re-appeal?

Yes, appeals usually must be filed within 30 days of receiving your rejection. Missing the deadline may result in automatic disqualification.

How long does SASSA take to review a re-appeal?

The Independent Tribunal usually reviews re-appeals within 60 to 90 days. Processing times may vary depending on the number of applications received.

Is re-appeal different from re-application?

Yes, re-appeal challenges a rejection, while re-application is used when SASSA opens a new SRD cycle. Both processes serve different purposes.